Portfolio Management

Portfolio Configuration

Edit and delete portfolios:

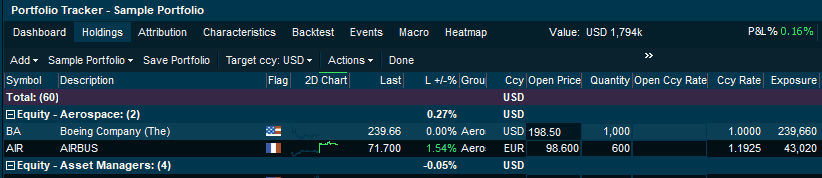

Edit holding properties

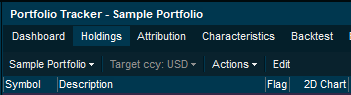

To edit holding quantity, open price, open currency an more, press the "Edit" button located in the Portfolio Tracker toolbar. The cells in question will appear with blue borders and are editable.

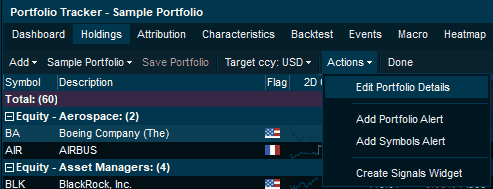

Edit portfolio properties

To modify properties of the portfolio such as name, currency, benchmark, and supporting information such as account number and ID, press the "Edit" button located in the Portfolio Tracker toolbar, and select the drop-down "Actions" > Portfolio Details

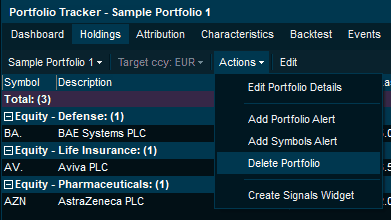

Delete Portfolios:

To delete a portfolio imported from Excel or created manually, select "Actions" > "Delete Portfolio" on the Portfolio Tracker toolbar.

Create Portfolio Alerts:

You can create portfolio alerts, both based on aggregate portfolio performance, as well as changes in individual instruments.

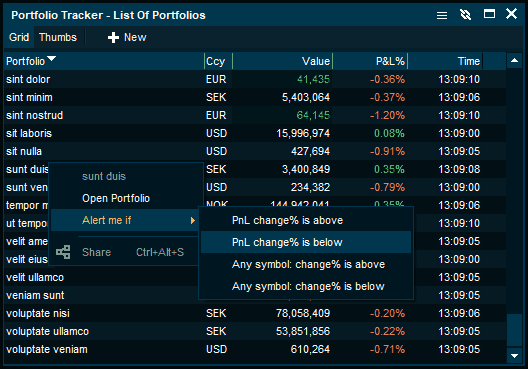

How to create an alert from the List of Portfolios window

Right click on the portfolio you want to monitor and navigate in the "Alert me if" sub-menu.

You can select between:

P&L change% above: based today's percentage change of total portfolio value

P&L change% below: based today's percentage change of total portfolio value

Any symbol change% above: based on today's percentage change of any instrument in the portfolio

Any symbol change% below: based on today's percentage change of any instrument in the portfolio

How to create an alert from the Portfolio Tracker window

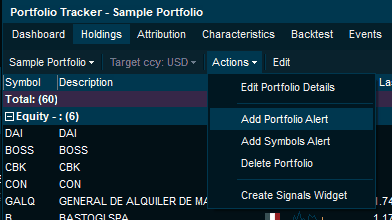

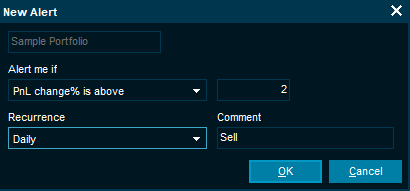

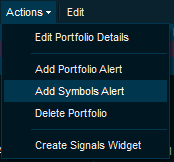

Click on the "Actions" drop-down located in the Portfolio Tracker toolbar and select "Add Portfolio Alert".

This action will open a window to input the conditions to be met to trigger the alert. P&L change% above/below is based today's percentage change of total portfolio value.

To create alerts on individual instruments in the portfolio, select "Add Symbols Alert".

Import & Create Portfolios:

Import portfolios from Portfolios Management Systems

If you have a Portfolio Management System, your portfolios will appear automatically on the "List of portfolios".

Import portfolios from Excel and CSV files

In the List of portfolios, press the New button.

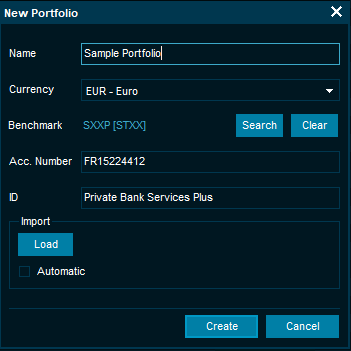

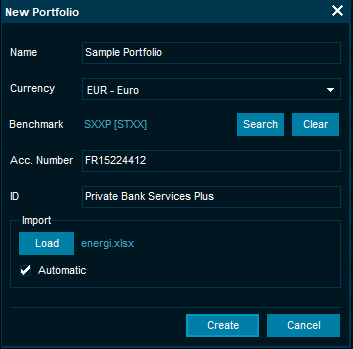

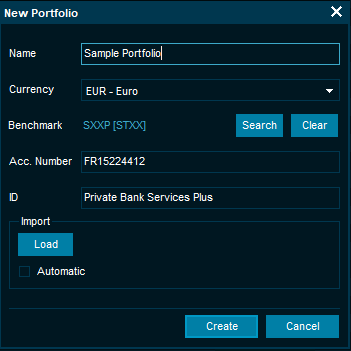

The "New Portfolio" window will open. You must give the portfolio a name and a base currency.

In addition, you can add the Portfolio's benchmark, and optionally descriptive information such as Account Number and internal ID.

To import your portfolio from an Excel or CSV file, press the "Load" button in the "Import" section of the New Portfolio window. A prompt will appear where you can map the different columns to the corresponding fields.

To load your file, navigate to the selected directory in your computer where you have saved your Excel or CSV file containing the portfolio holdings.

If you wish to maintain a single file, and automatically reflect those changes in your terminal, check the box "Automatic" located in the Import section of the New Portfolio window.

Creating portfolios manually

To create a new portfolio manually, press the New button in the List of portfolios.

The "New Portfolio" window will open. You must give the portfolio a name and a base currency.

In addition, you can add the Portfolio's benchmark, and optionally descriptive information such as Account Number and internal ID.

Press the button "Create" located on the bottom of the window, and an empty Portfolio Tracker will appear.

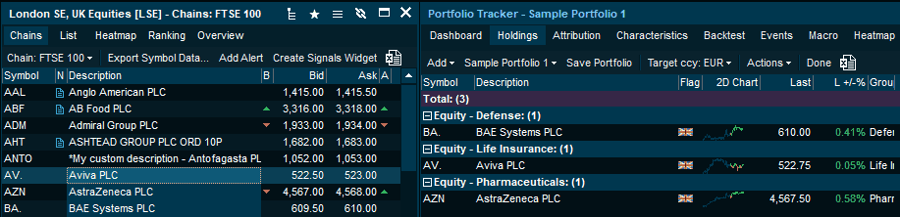

Dragging and dropping instruments

You can add instruments to the empty portfolio by simply dragging and dropping symbols from market windows.

Adding instruments in the Portfolio Tracker

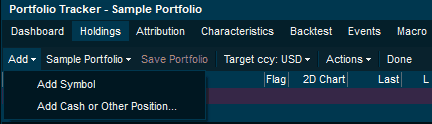

Press the button "Edit" located in the Portfolio Tracker toolbar.

The edit properties will be opened in the toolbar, and press "Add".

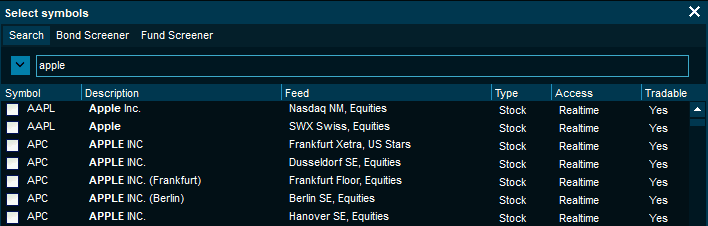

To add listed instruments, press "Add Symbol" and a search window help you to find the correct asset.

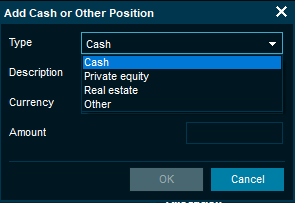

To add cash or non-traded instruments, select "Ass Cash or Other position". With this tool, you can add cash and alternative investments such as Private Equity, Real Estate, Hedge Funds, and more.

When adding cash positions, you can also add a description to specify whether it is deposits, offset cash, borrowings, etc.

Portfolio Tools

Portfolio Rebalancing

Portfolio Rebalancing on The Satoshi Terminal is a dynamic tool that allows users to systematically adjust the weights of assets within their investment portfolio. This process aims to bring the portfolio back to its target asset allocation, considering changes in market conditions, asset performance, and the investor's risk tolerance. The goal is to optimize the portfolio's risk-return characteristics and maintain alignment with the investor's long-term financial goals.

Key Features:

Target Asset Allocation:

Users set a target asset allocation based on their investment strategy, risk tolerance, and financial goals. This allocation serves as the benchmark for the desired distribution of assets in the portfolio.

Dynamic Rebalancing:

The tool monitors the actual asset allocation of the portfolio compared to the target allocation. When deviations occur due to market fluctuations or changes in asset values, the system triggers rebalancing to bring the portfolio back to its target distribution.

Risk Management:

Portfolio Rebalancing helps manage risk by preventing the portfolio from becoming overly concentrated in specific assets or asset classes. It ensures that risk exposure aligns with the investor's risk tolerance and overall risk management strategy.

Tax Efficiency:

The tool considers tax implications when rebalancing the portfolio. It aims to minimize tax consequences by strategically selling or buying assets to optimize the portfolio while considering tax implications such as capital gains.

Customizable Parameters:

Users can customize rebalancing parameters, including frequency (e.g., quarterly, annually), tolerance bands for allowable deviations from the target allocation, and tax considerations. This flexibility allows for tailored rebalancing strategies.

Reporting and Analytics:

Detailed reports and analytics provide users with insights into the impact of rebalancing on the portfolio's risk and return characteristics. Visualizations help users understand the effectiveness of the rebalancing strategy.

How It Works:

Set Target Asset Allocation:

Users define their target asset allocation based on investment objectives, risk tolerance, and financial goals. This allocation serves as the reference point for portfolio composition.

Monitor Portfolio Deviations:

The system continuously monitors the actual asset allocation of the portfolio. Deviations from the target allocation trigger the need for rebalancing when assets drift outside predefined tolerance bands.

Rebalancing Trigger:

When deviations occur, the Portfolio Rebalancing tool automatically generates buy or sell orders to bring the portfolio back to its target allocation. The system considers tax implications and executes trades strategically.

Execute Rebalancing Strategy:

The tool executes the rebalancing strategy, optimizing the portfolio composition while minimizing tax consequences. Assets are bought or sold according to the target allocation and market conditions.

Monitor Tax Implications:

Portfolio Rebalancing considers tax efficiency by analyzing potential tax implications of trades. It aims to minimize tax consequences while achieving the desired asset allocation.

Generate Reports and Insights:

Users can access detailed reports and analytics that provide insights into the impact of rebalancing on the portfolio's risk and return characteristics. Visualizations help users understand the effectiveness of the rebalancing strategy.

Theoretical Pricing

The Theoretical Pricing feature on The Satoshi Terminal enables users to calculate the theoretical value of financial instruments, such as stocks, bonds, derivatives, and other securities. This process involves employing sophisticated mathematical models and utilizing relevant market data to estimate the fair value of these instruments. The primary objective is to assess whether an asset is overvalued or undervalued relative to its theoretical or intrinsic value.

Key Features:

Advanced Mathematical Models:

The tool employs advanced mathematical models, such as option pricing models, discounted cash flow models, and other valuation methodologies, to calculate the theoretical price of financial instruments.

Real-time Market Data Integration:

The Theoretical Pricing feature integrates real-time market data, including asset prices, interest rates, and other relevant parameters, to ensure that the theoretical pricing reflects current market conditions.

Customizable Valuation Parameters:

Users can customize valuation parameters and assumptions based on their analysis and preferences. This flexibility allows for tailored theoretical pricing models that align with specific investment strategies.

Scenario Analysis:

The tool facilitates scenario analysis by allowing users to input different assumptions and parameters to observe how changes impact the theoretical pricing of financial instruments. This aids in understanding potential valuation uncertainties.

Comparative Analysis:

Users can compare the theoretical prices calculated by the tool with the actual market prices of assets. This comparative analysis helps identify potential discrepancies and market mispricing.

Visualizations and Reports:

Theoretical Pricing results are presented through visualizations and detailed reports, providing users with insights into potential mispricing and supporting decision-making processes.

How It Works:

Select Financial Instrument:

Users choose the financial instrument (e.g., stock, bond, option) for which they want to calculate the theoretical price.

Input Valuation Parameters:

Customize valuation parameters and assumptions based on the selected instrument and analysis. This may include interest rates, volatility, dividend yields, and other relevant factors.

Run Theoretical Pricing Calculation:

Initiate the Theoretical Pricing calculation by clicking on the "Calculate" button. The tool employs the chosen mathematical model and integrates real-time market data to estimate the fair value of the selected instrument.

Scenario Analysis (Optional):

Users can perform scenario analysis by adjusting parameters and assumptions to observe how changes impact the theoretical price. This helps assess the sensitivity of the valuation to different factors.

Compare with Market Prices:

Compare the calculated theoretical price with the actual market price of the financial instrument. Identify instances of potential mispricing or discrepancies that may present investment opportunities.

Generate Reports and Insights:

Access detailed reports and visualizations that present the results of the Theoretical Pricing analysis. Gain insights into potential market mispricing and use the information to inform investment decisions.

Customizable Reports

Execution Venues

Simulated Trading Engine

The Simulated Trading Engine on The Satoshi Terminal offers users a risk-free environment to execute trades and test investment strategies. It provides a simulated marketplace where users can interact with financial instruments, execute trades, and observe the performance of their portfolios in real-time. This feature is instrumental for investors, traders, and analysts seeking to refine their strategies, assess the effectiveness of algorithms, and make informed decisions based on simulated market conditions.

Key Features:

Simulated Trading Environment:

The tool creates a simulated trading environment that replicates real market conditions. Users can execute trades, monitor portfolio performance, and experience the dynamics of a virtual marketplace.

Trade Execution and Order Types:

Users can execute various types of trades and utilize different order types, including market orders, limit orders, stop orders, and more. This allows for a comprehensive simulation of different trading scenarios.

Real-time Market Data Feed:

The Simulated Trading Engine integrates a real-time market data feed, providing users with up-to-date information on asset prices, volumes, and other relevant market indicators during the simulation.

Algorithmic Trading Simulation:

For users employing algorithmic trading strategies, the Simulated Trading Engine supports the simulation of algorithmic trading scenarios. This allows users to test and refine their algorithms in a risk-free environment.

Risk Management Simulation:

Users can simulate risk management strategies by setting parameters for portfolio diversification, position sizing, and stop-loss levels. Evaluate the impact of risk management on overall portfolio performance.

Performance Analytics:

The tool generates performance analytics and reports, including metrics such as returns, volatility, drawdowns, and Sharpe ratio. Users can assess the effectiveness of their trading and investment strategies based on simulated outcomes.

Scenario Analysis:

Conduct scenario analysis by simulating different market conditions, economic events, or changes in trading strategies. Evaluate how portfolios perform under various scenarios to make informed decisions.

How It Works:

Select Financial Instruments:

Users choose the financial instruments they want to include in the simulation. This could include stocks, bonds, options, or other tradable assets.

Set Initial Portfolio:

Define the initial portfolio by specifying the allocation of assets and initial investment amounts. This establishes the starting point for the simulation.

Execute Simulated Trades:

Users can execute simulated trades by placing orders through the Simulated Trading Engine. The tool provides a range of order types and execution options to replicate real-world trading scenarios.

Monitor Portfolio Performance:

Track the performance of the simulated portfolio in real-time. Gain insights into returns, volatility, and other key performance metrics.

Algorithmic Trading Simulation (Optional):

For users employing algorithmic trading strategies, simulate the execution of algorithmic trades and evaluate the performance of algorithms within the simulated environment.

Evaluate Risk Management Strategies:

Assess the impact of different risk management strategies on portfolio performance. Test parameters such as stop-loss levels, position sizing, and diversification to optimize risk-adjusted returns.

Generate Reports and Insights:

Access detailed reports and analytics summarizing the results of the simulated trading scenarios. Evaluate the effectiveness of strategies, identify areas for improvement, and make data-driven decisions.

Complex Ordering

Virtual Portfolios

Virtual Portfolios on The Satoshi Terminal provide users with a simulated platform to build and manage investment portfolios using virtual funds. This feature replicates real market conditions, enabling users to explore various investment strategies, assess the performance of different asset allocations, and gain valuable insights into the dynamics of portfolio management.

Key Features:

Simulated Trading Environment:

The Virtual Portfolios feature creates a realistic simulated trading environment that mirrors actual market conditions. Users can experience the dynamics of portfolio management without exposing real capital.

Customizable Portfolio Creation:

Users can create and customize virtual portfolios by selecting a variety of financial instruments, including stocks, bonds, ETFs, and other asset classes. This allows for the exploration of different investment themes and strategies.

Risk-Free Investing:

Since Virtual Portfolios use virtual funds, users can experiment with various investment approaches without the risk of actual financial loss. This is particularly beneficial for users who want to build confidence in their investment decisions.

Asset Allocation Testing:

Test and optimize different asset allocations within the virtual portfolios. Explore the impact of diversification, sector exposure, and other allocation strategies to understand how they influence portfolio performance.

Real-time Market Data Integration:

The feature integrates real-time market data, providing users with up-to-date information on asset prices, market trends, and other relevant indicators during the virtual portfolio simulation.

Performance Analytics:

Virtual Portfolios generate performance analytics and reports, including metrics such as total returns, volatility, and portfolio value over time. Users can analyze the effectiveness of their virtual portfolios and make informed decisions.

Scenario Analysis:

Conduct scenario analysis by simulating different market conditions, economic events, or changes in investment strategies within the virtual portfolios. This allows users to anticipate and plan for various scenarios.

How It Works:

Create a Virtual Portfolio:

Users start by creating a virtual portfolio, selecting the financial instruments they want to include and defining the initial allocation of virtual funds.

Execute Virtual Trades:

Users can execute virtual trades within the simulated environment, buying and selling assets based on their investment decisions. The tool supports various order types and execution options.

Monitor Portfolio Performance:

Track the performance of virtual portfolios in real-time. Analyze metrics such as returns, volatility, and portfolio value to understand how different investment decisions impact performance.

Test Asset Allocations:

Experiment with different asset allocations to observe their impact on portfolio performance. Test variations in sector exposure, geographic diversification, and other allocation strategies.

Scenario Analysis (Optional):

Users can perform scenario analysis within the virtual portfolios, simulating different economic or market scenarios to evaluate the resilience and adaptability of their investment strategies.

Generate Reports and Insights:

Access detailed reports and analytics summarizing the results of virtual portfolio simulations. Analyze the performance of different strategies, identify areas for improvement, and make informed decisions.

Portfolio Timing Models

Momentum Rotation

The Momentum Rotation feature on The Satoshi Terminal is an advanced tool designed to assess the historical performance of portfolios employing momentum-based rotation strategies. This specialized functionality allows users to backtest investment approaches that dynamically rotate assets based on momentum signals. Below is a comprehensive description of the Momentum Rotation feature:

Description: Momentum Rotation on The Satoshi Terminal caters to investors and portfolio managers seeking to evaluate the historical performance of portfolios with momentum-based rotation strategies. This feature empowers users to backtest strategies that intelligently rotate assets based on momentum signals, aiming to capture trends and enhance overall performance. By leveraging historical data, users can gain insights into how momentum rotation strategies would have performed over different market conditions.

Key Features:

Momentum-Based Asset Rotation:

The feature enables users to backtest portfolios with momentum-based asset rotation strategies. Explore approaches that dynamically adjust asset allocations to capitalize on prevailing momentum signals in the market.

Historical Performance Evaluation:

Users can evaluate the historical performance of portfolios with momentum rotation strategies. Assess returns, risk metrics, and other key performance indicators over specified historical periods, considering the effectiveness of momentum-based rotations.

Signal-Driven Rotation Strategies:

Backtest signal-driven rotation strategies that leverage momentum signals or indicators to intelligently rotate assets. Understand how these strategies would have performed historically in capturing trends and exploiting momentum.

Risk-Return Analysis:

Conduct a comprehensive risk-return analysis by examining the trade-offs between risk and return associated with portfolios utilizing momentum rotation. Gain insights into how momentum-based rotations impact overall performance.

Parameterized Rotation Signals:

Momentum Rotation Backtesting allows for the parameterization of rotation signals. Users can customize momentum signals and indicators for asset rotation, tailoring the backtesting process to specific investment strategies.

Visualizations and Reports:

Interactive visualizations and detailed reports present Momentum Rotation Backtesting results in a format conducive to decision-making. Visual representations aid in understanding the historical performance dynamics of portfolios with momentum-based rotations.

How It Works:

Define Momentum Rotation Signals:

Specify momentum rotation signals or indicators based on market trends, price momentum, or other criteria. Define how asset rotations should be driven by momentum signals over the backtesting period.

Select Historical Periods:

Specify historical periods for backtesting, considering different market conditions and economic cycles. Users have the flexibility to assess the performance of portfolios with momentum rotations over varying time horizons.

Run Momentum Rotation Backtesting:

Initiate the Momentum Rotation Backtesting process by clicking on the "Run Backtest" button. The tool leverages historical market data to simulate the performance of portfolios with intelligently rotated assets based on momentum signals.

Explore Backtesting Results:

Explore the results of the backtesting process through interactive charts and reports. Gain insights into the historical performance, risk characteristics, and effectiveness of portfolios with momentum-based rotations.

Optimize Rotation Strategies:

Utilize backtesting insights to optimize momentum rotation strategies. Identify signals that have historically performed well in capturing trends and refining rotation parameters for improved risk-adjusted returns.

Benefit to Users: Momentum Rotation on The Satoshi Terminal provides users with a powerful tool for evaluating the historical performance of portfolios employing momentum-based rotation strategies. By assessing the effectiveness of capturing trends and exploiting momentum, investors can gain valuable insights, inform decision-making, and optimize their investment approaches for improved future performance. This feature is particularly valuable for those seeking data-driven assessments of strategies that dynamically rotate assets based on momentum signals in evolving market conditions.

Dual Momentum

The Dual Momentum feature on The Satoshi Terminal is a sophisticated tool designed to assess the historical performance of portfolios utilizing dual momentum strategies. This specialized functionality allows users to backtest investment approaches that leverage both relative strength and absolute momentum signals. Below is a comprehensive description of the Dual Momentum feature:

Description: Dual Momentum on The Satoshi Terminal caters to investors and portfolio managers seeking to evaluate the historical performance of portfolios with dual momentum strategies. This feature empowers users to backtest strategies that intelligently combine relative strength and absolute momentum signals, aiming to capture strong trends and enhance overall performance. By leveraging historical data, users can gain insights into how dual momentum strategies would have performed over different market conditions.

Key Features:

Combined Relative Strength and Absolute Momentum:

The feature enables users to backtest portfolios with dual momentum strategies, combining relative strength and absolute momentum signals. Explore approaches that dynamically adjust asset allocations based on both the strength of assets and their momentum.

Historical Performance Evaluation:

Users can evaluate the historical performance of portfolios with dual momentum strategies. Assess returns, risk metrics, and other key performance indicators over specified historical periods, considering the effectiveness of the dual momentum approach.

Signal Integration for Asset Allocation:

Backtest signal integration for asset allocation, where relative strength and absolute momentum signals are integrated to make informed decisions about portfolio allocations. Understand how this integrated approach would have performed historically.

Risk-Return Analysis:

Conduct a comprehensive risk-return analysis by examining the trade-offs between risk and return associated with portfolios utilizing dual momentum. Gain insights into how the combination of relative strength and absolute momentum impacts overall performance.

Parameterized Momentum Signals:

Dual Momentum Backtesting allows for the parameterization of both relative strength and absolute momentum signals. Users can customize momentum signals and indicators for intelligent asset allocation, tailoring the backtesting process to specific investment strategies.

Visualizations and Reports:

Interactive visualizations and detailed reports present Dual Momentum Backtesting results in a format conducive to decision-making. Visual representations aid in understanding the historical performance dynamics of portfolios with dual momentum strategies.

How It Works:

Define Dual Momentum Signals:

Specify both relative strength and absolute momentum signals or indicators based on market trends, price momentum, or other criteria. Define how asset allocations should be dynamically adjusted based on the combination of these signals over the backtesting period.

Select Historical Periods:

Specify historical periods for backtesting, considering different market conditions and economic cycles. Users have the flexibility to assess the performance of portfolios with dual momentum over varying time horizons.

Run Dual Momentum Backtesting:

Initiate the Dual Momentum Backtesting process by clicking on the "Run Backtest" button. The tool leverages historical market data to simulate the performance of portfolios with intelligently adjusted asset allocations based on both relative strength and absolute momentum signals.

Explore Backtesting Results:

Explore the results of the backtesting process through interactive charts and reports. Gain insights into the historical performance, risk characteristics, and effectiveness of portfolios with dual momentum strategies.

Optimize Momentum Signals Integration:

Utilize backtesting insights to optimize the integration of dual momentum signals. Identify combinations of relative strength and absolute momentum signals that have historically performed well and refine integration parameters for improved risk-adjusted returns.

Adaptive Allocation

The Adaptive Allocation feature on The Satoshi Terminal is an innovative tool designed to evaluate the historical performance of portfolios utilizing adaptive asset allocation strategies. This advanced functionality allows users to backtest investment approaches that intelligently adjust asset allocations based on evolving market conditions. Below is a comprehensive description of the Adaptive Allocation feature:

Description: Adaptive Allocation on The Satoshi Terminal caters to investors and portfolio managers seeking to assess the historical performance of portfolios with adaptive asset allocation strategies. This feature empowers users to backtest intelligent approaches that dynamically adjust asset allocations in response to changing market conditions. By leveraging historical data, users can gain insights into how adaptive allocation strategies would have performed over different market environments.

Key Features:

Intelligent Asset Allocation:

The feature enables users to backtest portfolios with intelligent and adaptive asset allocations. Explore strategies that dynamically respond to market signals, economic indicators, or other factors, optimizing allocations for enhanced performance.

Historical Performance Evaluation:

Users can evaluate the historical performance of portfolios with adaptive asset allocations. Assess returns, risk metrics, and other key performance indicators over specified historical periods, considering the intelligence behind allocation adjustments.

Signal-Based Allocation Strategies:

Backtest signal-based allocation strategies that leverage predefined signals or indicators to adjust asset weights intelligently. Understand how these adaptive strategies would have performed historically.

Risk-Return Analysis:

Conduct a comprehensive risk-return analysis by examining the trade-offs between risk and return associated with portfolios utilizing adaptive asset allocations. Gain insights into how intelligence in allocation adjustments impacts performance.

Parameterized Allocation Signals:

Adaptive Allocation Backtesting allows for the parameterization of allocation signals. Users can customize signals and indicators for intelligently adjusting asset weights, tailoring the backtesting process to specific investment strategies.

Visualizations and Reports:

Interactive visualizations and detailed reports present Adaptive Allocation Backtesting results in a format conducive to decision-making. Visual representations aid in understanding the historical performance dynamics of portfolios with adaptive asset allocations.

How It Works:

Define Adaptive Allocation Signals:

Specify adaptive allocation signals or indicators based on market insights, economic factors, or other criteria. Define how asset allocations should intelligently adapt to changing conditions over the backtesting period.

Select Historical Periods:

Specify historical periods for backtesting, considering different market conditions and economic cycles. Users have the flexibility to assess the performance of portfolios with adaptive allocations over varying time horizons.

Run Adaptive Allocation Backtesting:

Initiate the Adaptive Allocation Backtesting process by clicking on the "Run Backtest" button. The tool leverages historical market data to simulate the performance of portfolios with intelligently adjusted asset allocations.

Explore Backtesting Results:

Explore the results of the backtesting process through interactive charts and reports. Gain insights into the historical performance, risk characteristics, and adaptability of portfolios with adaptive asset allocations.

Optimize Allocation Strategies:

Utilize backtesting insights to optimize adaptive allocation strategies. Identify signals that have historically performed well in adapting to market conditions and refine allocation parameters for improved risk-adjusted returns.

Target Volatility

The Target Volatility feature on The Satoshi Terminal is an advanced tool designed to assess the historical performance of portfolios with target volatility strategies. This specialized functionality allows users to backtest investment approaches that aim to maintain a specific level of portfolio volatility. Below is a comprehensive description of the Target Volatility feature:

Description: Target Volatility on The Satoshi Terminal caters to investors and portfolio managers seeking to evaluate the historical performance of portfolios with target volatility strategies. This feature empowers users to backtest strategies that dynamically adjust asset allocations to achieve and maintain a predefined level of portfolio volatility. By leveraging historical data, users can gain insights into how target volatility strategies would have performed over different market conditions.

Key Features:

Dynamic Asset Allocation for Volatility Control:

The feature enables users to backtest portfolios with dynamic asset allocation strategies for volatility control. Explore approaches that adjust asset allocations to achieve and maintain a target level of portfolio volatility.

Historical Performance Evaluation:

Users can evaluate the historical performance of portfolios with target volatility strategies. Assess returns, risk metrics, and other key performance indicators over specified historical periods, considering the effectiveness of volatility control.

Volatility-Based Allocation Rules:

Backtest volatility-based allocation rules that intelligently adjust asset weights to align with the target volatility. Understand how these strategies would have performed historically in managing and controlling portfolio volatility.

Risk-Return Analysis:

Conduct a comprehensive risk-return analysis by examining the trade-offs between risk and return associated with portfolios utilizing target volatility strategies. Gain insights into how volatility control impacts overall performance.

Parameterized Volatility Targets:

Target Volatility Backtesting allows for the parameterization of volatility targets. Users can customize target volatility levels based on risk preferences and investment objectives, tailoring the backtesting process to specific strategies.

Visualizations and Reports:

Interactive visualizations and detailed reports present Target Volatility Backtesting results in a format conducive to decision-making. Visual representations aid in understanding the historical performance dynamics of portfolios with target volatility strategies.

How It Works:

Define Target Volatility Levels:

Specify target volatility levels based on risk preferences and investment objectives. Define the desired level of portfolio volatility that the strategy aims to achieve and maintain over the backtesting period.

Select Historical Periods:

Specify historical periods for backtesting, considering different market conditions and economic cycles. Users have the flexibility to assess the performance of portfolios with target volatility over varying time horizons.

Run Target Volatility Backtesting:

Initiate the Target Volatility Backtesting process by clicking on the "Run Backtest" button. The tool leverages historical market data to simulate the performance of portfolios with dynamically adjusted asset allocations to achieve and maintain the target volatility.

Explore Backtesting Results:

Explore the results of the backtesting process through interactive charts and reports. Gain insights into the historical performance, risk characteristics, and effectiveness of portfolios with target volatility strategies.

Optimize Volatility Control Strategies:

Utilize backtesting insights to optimize target volatility strategies. Identify volatility targets and allocation rules that have historically performed well in achieving and maintaining the desired level of portfolio volatility.

Core-Satellite

The Core-Satellite Portfolio Strategy feature on The Satoshi Terminal is a comprehensive tool designed to assess the historical performance of portfolios following the core-satellite approach. This sophisticated functionality allows users to backtest investment strategies that combine a core portfolio with satellite portfolios, offering a balanced and diversified investment approach. Below is a comprehensive description of the Core-Satellite Portfolio Strategy feature:

Description: The Core-Satellite Portfolio Strategy on The Satoshi Terminal caters to investors and portfolio managers seeking to evaluate the historical performance of portfolios using the core-satellite approach. This feature empowers users to backtest strategies that combine a core portfolio, representing the foundation of the investment strategy, with satellite portfolios that provide opportunities for alpha generation or targeted exposures. By leveraging historical data, users can gain insights into how the core-satellite approach would have performed over different market conditions.

Key Features:

Core Portfolio Foundation:

The feature enables users to define a core portfolio that forms the foundation of the investment strategy. The core portfolio typically consists of broad-market, well-diversified assets.

Satellite Portfolios for Specific Exposures:

Users can create satellite portfolios designed to achieve specific objectives, such as alpha generation, sector exposure, or thematic investments. These satellite portfolios complement the core portfolio.

Historical Performance Evaluation:

Backtest the historical performance of the overall portfolio, considering the combination of core and satellite portfolios. Assess returns, risk metrics, and other key performance indicators over specified historical periods.

Dynamic Asset Allocation:

Explore dynamic asset allocation strategies between the core and satellite portfolios. Backtest different weightings and rebalancing frequencies to optimize the overall portfolio's performance.

Risk-Return Analysis:

Conduct a comprehensive risk-return analysis by examining the trade-offs between risk and return associated with the core-satellite approach. Gain insights into how the combination of core and satellite portfolios impacts overall performance.

Customizable Portfolio Components:

Core-Satellite Portfolio Backtesting allows for the customization of core and satellite portfolio components. Users can tailor the assets included in each portfolio to align with their investment preferences and objectives.

Visualizations and Reports:

Interactive visualizations and detailed reports present Core-Satellite Portfolio Backtesting results in a format conducive to decision-making. Visual representations aid in understanding the historical performance dynamics of portfolios following the core-satellite approach.

How It Works:

Define Core Portfolio Composition:

Specify the assets and weightings that form the core portfolio. Design the core to provide a stable foundation for the overall portfolio.

Create Satellite Portfolios:

Develop satellite portfolios with specific objectives, such as alpha generation or targeted exposures. Customize each satellite portfolio to complement the core and achieve desired outcomes.

Select Historical Periods:

Specify historical periods for backtesting, considering different market conditions and economic cycles. Users have the flexibility to assess the performance of the core-satellite portfolio over varying time horizons.

Run Core-Satellite Portfolio Backtesting:

Initiate the Core-Satellite Portfolio Backtesting process by clicking on the "Run Backtest" button. The tool leverages historical market data to simulate the performance of the overall portfolio.

Explore Backtesting Results:

Explore the results of the backtesting process through interactive charts and reports. Gain insights into the historical performance, risk characteristics, and effectiveness of the core-satellite portfolio strategy.

Optimize Asset Allocations:

Utilize backtesting insights to optimize asset allocations between the core and satellite portfolios. Identify weightings and rebalancing strategies that have historically achieved the desired balance of stability and alpha generation.

Factor Analysis Tools

Factor Regression

The Factor Regression feature on The Satoshi Terminal is an advanced analytical tool designed to dissect the performance of portfolios and investment strategies. Leveraging factor regression analysis, this feature allows users to understand the impact of key factors on portfolio returns, providing insights into risk exposures and performance attribution. Below is a comprehensive description of the Factor Regression feature:

Description: The Factor Regression feature on The Satoshi Terminal empowers users to conduct detailed analysis of portfolio performance through factor regression. This sophisticated tool systematically assesses the influence of key factors, such as market risk, size, value, momentum, and others, on portfolio returns. By unraveling the underlying factors driving performance, users can make informed decisions, optimize portfolios, and enhance risk management.

Key Features:

Factor Regression Analysis:

The feature conducts factor regression analysis to quantify the impact of various factors on portfolio returns. This includes assessing the contributions of market risk, size, value, momentum, and other relevant dimensions.

Risk Exposure Identification:

Users can identify and understand the risk exposures within their portfolios through factor regression. This includes discerning how different factors contribute to the overall risk profile of the investment strategy.

Performance Attribution:

Assess the performance attribution of portfolios by analyzing how specific factors contribute to returns. Factor regression enables users to distinguish between skill-based returns and those driven by underlying market factors.

Customizable Analysis:

Customize factor regression analysis by selecting specific factors of interest. Tailor the analysis to align with the unique characteristics of the portfolio and the user's risk preferences.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present factor regression results in a comprehensible format. Visual representations aid in interpreting the relationships between portfolio returns and contributing factors.

How It Works:

Select Portfolio and Factors:

Choose the portfolio for factor regression analysis. Specify the key factors, such as market risk, size, value, momentum, and others, that you want to analyze in relation to portfolio returns.

Run Factor Regression Analysis:

Initiate the factor regression analysis by clicking on the "Run Regression" button. The tool processes the selected portfolio and factors, providing detailed insights into the relationships between them.

Explore Results:

Explore the results of the factor regression analysis through interactive charts and reports. Understand how each factor contributes to portfolio returns and identify the key drivers of performance.

Risk Exposure Assessment:

Assess the risk exposures identified through factor regression. Understand the impact of different factors on the overall risk profile of the portfolio, aiding in risk management and mitigation strategies.

Performance Attribution Insights:

Gain insights into performance attribution by analyzing how specific factors contribute to returns. Distinguish between skill-based returns and those attributed to underlying market dynamics, enhancing the understanding of portfolio performance.

Risk Factor Allocation

The Risk Factor Allocation feature on The Satoshi Terminal is a sophisticated tool designed to optimize portfolio risk management by systematically allocating risk across key factors. This feature empowers users to identify, assess, and allocate risk exposure to various factors, providing a nuanced approach to portfolio construction and optimization. Below is a comprehensive description of the Risk Factor Allocation feature:

Description: The Risk Factor Allocation feature on The Satoshi Terminal is a strategic tool that enhances portfolio risk management through systematic allocation across key factors. By identifying and understanding the impact of various risk factors, users can optimize their portfolios to align with specific risk preferences and investment goals. This feature employs advanced methodologies to allocate risk intelligently and foster a more resilient portfolio.

Key Features:

Factor Risk Identification:

Users can identify and assess the impact of key risk factors on portfolio performance. This includes factors such as market risk, interest rate risk, currency risk, credit risk, and other relevant dimensions.

Dynamic Allocation:

The feature dynamically allocates portfolio risk across identified factors based on real-time market conditions. This adaptability ensures that risk allocation remains aligned with the evolving financial landscape.

Customizable Risk Preferences:

Investors have the flexibility to customize risk preferences and factor weights based on their unique investment strategies. Tailor risk allocations to align with specific risk tolerance levels and performance objectives.

Risk Attribution:

Understand the contribution of each risk factor to overall portfolio risk. The tool provides detailed risk attribution, enabling users to discern the sources of risk and make informed adjustments.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present risk factor allocations in a clear and concise manner. Visual representations aid in interpreting the impact of different factors on portfolio risk.

How It Works:

Identify Key Risk Factors:

Choose the key risk factors for analysis, including market risk, interest rate risk, currency risk, credit risk, and others. This step ensures a comprehensive assessment of risk exposure.

Dynamic Allocation Process:

Initiate the risk factor allocation process by selecting the appropriate risk factors and clicking on the "Allocate Risk" button. The tool dynamically adjusts portfolio weights based on the identified factors.

Customize Risk Preferences:

Customize risk preferences by adjusting factor weights according to specific risk tolerance levels and investment goals. This customization empowers users to tailor risk allocations to their unique preferences.

Review Risk Attribution:

Examine the risk attribution results, which detail the contribution of each factor to overall portfolio risk. This insight facilitates a deeper understanding of the portfolio's risk profile.

Optimize Portfolio Construction:

Utilize risk factor allocation insights to optimize portfolio construction. Allocate assets strategically based on risk factors to achieve a balanced and resilient portfolio.

Match Factor Exposures

The Match Factor Exposures feature on The Satoshi Terminal is a sophisticated tool designed to align and match factor exposures across various portfolios. This advanced functionality allows users to compare and synchronize factor exposures, facilitating a harmonized approach to factor-based investing. Below is a comprehensive description of the Match Factor Exposures feature:

Description: The Match Factor Exposures feature on The Satoshi Terminal offers users the ability to align and synchronize factor exposures across multiple portfolios. This advanced tool enables investors to compare the factor exposures of different portfolios, identify disparities, and strategically match factor weights. By harmonizing factor exposures, users can maintain consistency in their factor-based investment strategies.

Key Features:

Factor Exposure Alignment:

The feature facilitates the alignment of factor exposures across different portfolios. Users can specify the factors of interest and match the weights to ensure consistency in factor exposures.

Portfolio Comparison:

Conduct a comprehensive comparison of factor exposures between multiple portfolios. Identify variations in factor weights and make strategic adjustments to achieve a desired level of exposure consistency.

Dynamic Matching:

Users can dynamically match factor exposures based on real-time market conditions. This adaptability ensures that factor exposures remain synchronized in response to changes in the financial landscape.

Customizable Matching Criteria:

Customize matching criteria by specifying the factors to be considered and setting matching thresholds. Tailor the matching process to align with specific investment goals and factor preferences.

Visualizations and Reports:

Access interactive visualizations and detailed reports that illustrate the matched factor exposures. Visual representations aid in comprehending the level of alignment achieved and highlight any remaining disparities.

How It Works:

Select Portfolios and Factors:

Choose the portfolios for factor exposure matching. Specify the factors of interest that you want to align across the selected portfolios.

Define Matching Criteria:

Set matching criteria, including matching thresholds and specific factors to consider. Customize the matching process to align with your desired level of factor exposure consistency.

Run Factor Exposure Matching:

Initiate the matching process by clicking on the "Match Exposures" button. The tool dynamically adjusts factor weights to achieve alignment based on the specified matching criteria.

Review Matching Results:

Review the results of the factor exposure matching process. Visualize the matched factor exposures through interactive charts and reports, identifying any remaining disparities.

Optimize Consistency:

Utilize the insights gained from matching results to make strategic adjustments and optimize factor exposure consistency across portfolios. Ensure that factor weights align with the desired investment strategy.

Principal Component Analysis

The Principal Component Analysis (PCA) feature on The Satoshi Terminal is a sophisticated analytical tool designed to unravel complex relationships within financial datasets. By employing PCA, this feature enables users to identify key factors driving portfolio performance, reduce dimensionality, and enhance decision-making. Below is a comprehensive description of the Principal Component Analysis feature:

Description: The Principal Component Analysis feature on The Satoshi Terminal empowers users to unlock the latent patterns and underlying structures within financial datasets. PCA is a powerful mathematical technique that transforms original variables into a set of uncorrelated variables called principal components. This feature is designed to provide users with a comprehensive understanding of the key drivers influencing portfolio dynamics, facilitating informed investment decisions.

Key Features:

Dimensionality Reduction:

PCA reduces the dimensionality of financial datasets by transforming them into a smaller set of principal components. This simplification enhances the interpretability of complex data.

Identifying Key Factors:

Users can identify the key factors or principal components that explain the majority of variance within the dataset. This insight aids in focusing on the most influential elements driving portfolio performance.

Risk Decomposition:

PCA enables the decomposition of portfolio risk into individual principal components. This allows users to discern the sources of risk within their portfolios and make targeted risk management decisions.

Portfolio Construction:

Utilize PCA results for portfolio construction by weighting assets based on their contributions to principal components. This approach helps optimize portfolio composition for enhanced risk-return profiles.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present PCA results in a user-friendly format. Visual representations aid in comprehending the relationships and contributions of variables.

How It Works:

Select Financial Dataset:

Choose the financial dataset for PCA analysis. This dataset may include asset returns, market indicators, or other relevant financial variables.

Run Principal Component Analysis:

Initiate the PCA analysis by selecting the appropriate variables and clicking on the "Run PCA" button. The tool transforms the dataset into principal components and extracts valuable insights.

Explore Principal Components:

Explore the identified principal components and their contributions to overall variance. Identify the key factors driving portfolio dynamics and understand their significance.

Risk Decomposition:

Assess the risk decomposition provided by PCA. Understand how individual principal components contribute to portfolio risk, facilitating a more nuanced risk management approach.

Portfolio Optimization:

Leverage PCA results for portfolio optimization by assigning weights to assets based on their contributions to principal components. This approach enhances portfolio construction and aligns it with identified key factors.

Fund Factor Regressions

The Fund Factor Regressions feature on The Satoshi Terminal is a robust analytical tool designed to provide comprehensive insights into the performance of investment funds. By leveraging factor regression analysis, this feature allows users to understand the factors influencing fund returns and make informed investment decisions. Below is an in-depth description of the Fund Factor Regressions feature:

Description: The Fund Factor Regressions feature on The Satoshi Terminal empowers users to delve deep into the performance of investment funds through advanced factor regression analysis. This tool systematically analyzes the factors influencing fund returns, offering a nuanced understanding of performance drivers. By unraveling the impact of various factors, users can make data-driven decisions to optimize their fund portfolios.

Key Features:

Factor Regression Analysis:

The feature conducts factor regression analysis to identify and quantify the impact of key factors on fund returns. This includes factors such as market risk, size, value, momentum, and others.

Performance Attribution:

Gain insights into fund performance attribution by understanding the contribution of specific factors. This feature helps users discern the sources of fund returns, leading to more informed investment strategies.

Risk Assessment:

Assess fund risks by examining factor exposures and sensitivities. The tool provides a comprehensive risk assessment, allowing users to proactively manage and mitigate potential risks in their fund portfolios.

Customizable Analysis:

Customize factor regression analysis based on user preferences and investment goals. Tailor the analysis to focus on specific factors or time periods, providing flexibility for detailed exploration.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present factor regression results in an easy-to-understand format. Visual representations aid in interpreting complex relationships between fund performance and various factors.

How It Works:

Select Fund and Factors:

Choose the specific investment fund for factor regression analysis. Select the factors of interest, such as market risk, size, value, momentum, and others, to tailor the analysis.

Run Factor Regression:

Initiate the factor regression analysis by clicking on the "Run Regression" button. The tool processes the selected fund and factors to generate comprehensive regression results.

Explore Results:

Explore the results through interactive visualizations and detailed reports. Understand the impact of each factor on the fund's returns and identify the key drivers contributing to performance.

Performance Attribution:

Evaluate performance attribution by assessing how each factor contributes to fund returns. This feature enables users to distinguish between skill-based returns and factor-driven performance.

Risk Assessment:

Assess the fund's risk profile by examining factor exposures. Identify potential risks associated with specific factors and make informed decisions to optimize the fund portfolio's risk-return profile.

Fund Performance Attribution

The Fund Performance Attribution feature on The Satoshi Terminal is an advanced analytical tool designed to dissect the performance of investment funds, providing users with a comprehensive understanding of the factors driving returns. Through meticulous attribution analysis, this feature enables investors to discern the sources of fund performance, distinguishing between skill-based returns and market-driven factors. Below is a detailed description of the Fund Performance Attribution feature:

Description: The Fund Performance Attribution feature on The Satoshi Terminal empowers users to unravel the complexities of investment fund performance. By conducting in-depth attribution analysis, this tool systematically breaks down fund returns into components, allowing users to identify and quantify the impact of various factors. Investors gain insights into how different elements contribute to overall performance, facilitating more informed decision-making.

Key Features:

Return Decomposition:

The feature decomposes fund returns into distinct components, including skill-based returns, market-driven returns, and other specific factors. This breakdown provides clarity on the origins of fund performance.

Identifying Key Drivers:

Users can identify and quantify the contribution of key drivers to fund performance. This includes factors such as security selection, asset allocation, timing decisions, and other relevant components.

Risk-Adjusted Analysis:

Conduct risk-adjusted analysis to assess the effectiveness of fund management in generating alpha. Evaluate fund performance in relation to risk factors, enhancing the understanding of risk-adjusted returns.

Time Series Analysis:

Explore fund performance attribution over different time periods. Conducting time series analysis allows users to identify trends, patterns, and changes in the impact of various factors on fund returns.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present fund performance attribution results in a comprehensible format. Visual representations aid in interpreting the nuanced relationships between fund returns and contributing factors.

How It Works:

Select Fund and Time Period:

Choose the specific investment fund for performance attribution analysis. Specify the time period of interest, allowing for flexibility in examining fund returns over different horizons.

Run Attribution Analysis:

Initiate the attribution analysis by selecting the appropriate parameters and clicking on the "Run Attribution" button. The tool systematically breaks down fund returns into their constituent components.

Explore Attribution Components:

Explore the results by examining the different components of fund performance attribution. Identify key drivers, including skill-based returns, market-driven factors, and other relevant components.

Risk-Adjusted Assessment:

Conduct risk-adjusted analysis to evaluate how fund performance compares to underlying risk factors. Assess the ability of fund managers to generate alpha while accounting for risk exposure.

Time Series Insights:

Gain insights into fund performance attribution over different time series. Analyze changes in the impact of various factors on fund returns, aiding in the identification of evolving trends.

Factor Exposure Analysis

The Factor Exposure Analysis feature on The Satoshi Terminal empowers investors with a robust tool to comprehensively analyze and understand the intricate factors influencing portfolio performance. This analytical tool is designed to enhance decision-making processes and facilitate effective risk management. Below is a detailed description of the Factor Exposure Analysis feature:

Description: The Factor Exposure Analysis feature on The Satoshi Terminal is a sophisticated analytical tool that delves into the multifaceted factors shaping the performance of your investment portfolio. Drawing inspiration from advanced financial models, this tool offers a comprehensive approach to factor exposure analysis. It allows users to scrutinize their portfolio's sensitivity to various factors, providing valuable insights for making informed investment decisions.

Key Features:

In-Depth Factor Coverage:

The tool covers a spectrum of critical factors, including market risk, interest rate risk, currency risk, credit risk, quality factor exposure, size factor exposure, value factor exposure, momentum factor exposure, volatility factor exposure, and liquidity factor exposure.

Customizable Analysis:

Investors have the flexibility to customize the analysis by selecting specific factors of interest. Tailor the analysis based on the unique characteristics of your portfolio and your risk preferences.

Comprehensive Reports:

Detailed reports are generated post-analysis, offering a comprehensive breakdown of factor exposures. These reports provide valuable insights into the impact of each factor on the portfolio.

Interactive Visualizations:

Leverage interactive charts and graphs to visually explore factor exposures. Customize visuals to emphasize specific data points, enabling a nuanced understanding of trends and patterns.

Export Functionality:

Export analysis results effortlessly in various formats, including PDF and Excel. This facilitates seamless sharing of reports with team members or clients for collaborative decision-making.

How It Works:

Factor Selection:

Navigate to the "Factors" section, where you can choose specific factors for analysis. This step allows you to focus on the factors most relevant to your portfolio.

Run Analysis:

Initiate the factor exposure analysis by clicking on the "Run Analysis" button. The tool processes the selected factors, providing insightful results for each aspect of your portfolio.

Review Reports:

Delve into the detailed reports generated post-analysis. These reports offer a granular understanding of how each factor influences your portfolio, aiding in strategic decision-making.

Interactive Visualization:

Utilize the interactive visualizations to explore factor exposures in a dynamic and engaging manner. Customize visuals to enhance your comprehension of the analysis results.

Export and Share:

Export analysis results with ease, selecting the format that suits your needs. Share comprehensive reports with your team or clients, fostering collaboration and informed decision-making.

Monte Carlo Analysis

Monte Carlo Simulation

The Monte Carlo Simulation feature on The Satoshi Terminal is a powerful analytical tool designed to assess and analyze the potential outcomes of investment strategies under uncertain market conditions. Leveraging advanced stochastic modeling, this feature enables users to simulate various scenarios, providing a probabilistic view of future portfolio performance. Below is a comprehensive description of the Monte Carlo Simulation feature:

Description: The Monte Carlo Simulation feature on The Satoshi Terminal empowers users to explore the potential outcomes of their investment strategies by simulating multiple scenarios. This advanced tool uses stochastic modeling to incorporate uncertainty and randomness, allowing investors to make informed decisions in the face of market variability. By running simulations, users gain valuable insights into the range of possible portfolio returns and risks.

Key Features:

Stochastic Modeling:

The feature employs stochastic modeling to simulate random market variables, capturing the inherent uncertainty in financial markets. This approach enables a more realistic and dynamic representation of potential future scenarios.

Scenario Analysis:

Users can conduct scenario analysis by running simulations under different market conditions. Explore a range of scenarios to understand how variations in market factors may impact portfolio performance.

Probability Distribution:

Monte Carlo Simulation generates probability distributions of potential portfolio returns, providing users with a probabilistic view of outcomes. This allows for a more nuanced understanding of the likelihood of achieving specific performance levels.

Risk Assessment:

Assess portfolio risks by analyzing the spread of potential outcomes in the simulation results. Identify worst-case and best-case scenarios, helping users make risk-informed decisions and refine risk management strategies.

Customizable Parameters:

Customize simulation parameters, including time horizons, market variables, and other relevant factors. Tailor simulations to align with specific investment goals and risk preferences.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present Monte Carlo Simulation results in an easily interpretable format. Visual representations aid in comprehending the range of potential outcomes and associated risks.

How It Works:

Define Simulation Parameters:

Specify simulation parameters, including time horizons, market variables, and any other factors relevant to the investment strategy. Customize the simulation to align with specific scenarios of interest.

Run Monte Carlo Simulation:

Initiate the Monte Carlo Simulation by clicking on the "Run Simulation" button. The tool generates multiple simulated scenarios by considering random variations in market factors.

Explore Simulation Results:

Explore the results of the Monte Carlo Simulation through interactive charts and reports. Gain insights into the probability distribution of potential portfolio returns and assess the impact of uncertainty on performance.

Scenario Analysis:

Conduct scenario analysis by examining how variations in market conditions affect simulated outcomes. Identify key factors influencing performance and use this information for strategic decision-making.

Risk-Informed Decision-Making:

Utilize the Monte Carlo Simulation results for risk-informed decision-making. Identify potential risks and opportunities, refine investment strategies, and make decisions that align with risk tolerance and objectives.

Monte Carlo Simulation Planning

The Monte Carlo Simulation Planning feature on The Satoshi Terminal offers a specialized tool designed for strategic planning and decision-making in dynamic environments. This unique functionality enables users to simulate a range of future scenarios, considering multiple factors, to develop robust plans and optimize decision pathways. Below is a comprehensive description of the Monte Carlo Simulation Planning feature:

Description: Monte Carlo Simulation Planning on The Satoshi Terminal is tailored for strategic planners and decision-makers looking to navigate uncertainty and optimize planning processes. This specialized tool utilizes advanced simulation techniques to generate a spectrum of potential future scenarios. By incorporating various influencing factors, users can develop resilient plans, anticipate uncertainties, and make strategic decisions that account for a broad range of possibilities.

Key Features:

Scenario Diversification:

The feature allows users to diversify scenarios by considering multiple influencing factors. This enables a more comprehensive exploration of potential outcomes, providing a holistic view of the planning landscape.

Dynamic Parameter Adjustment:

Users can dynamically adjust simulation parameters to reflect evolving conditions. This adaptability ensures that planning scenarios remain relevant and responsive to changes in the external environment.

Decision Pathway Optimization:

Monte Carlo Simulation Planning goes beyond traditional simulations by incorporating optimization algorithms. This feature helps users identify optimal decision pathways based on simulated scenarios, enhancing strategic planning capabilities.

Resource Allocation Strategies:

Develop resource allocation strategies by analyzing the impact of different scenarios on resource requirements. This enables more informed decisions regarding budgeting, staffing, and other key planning elements.

Customizable Planning Models:

Tailor planning models by specifying factors of interest, adjusting risk tolerance levels, and setting optimization criteria. This customization empowers users to align the simulation with unique planning objectives.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present Monte Carlo Simulation Planning results in a format conducive to strategic decision-making. Visual representations aid in understanding the diverse range of planning outcomes.

How It Works:

Define Planning Objectives:

Specify planning objectives and key performance indicators. Clearly define the factors that influence planning outcomes, such as market conditions, resource availability, or external variables.

Configure Simulation Parameters:

Configure simulation parameters, including the range and variability of influencing factors. Users have the flexibility to adjust parameters dynamically, ensuring that simulations align with evolving planning requirements.

Run Monte Carlo Simulation Planning:

Initiate the Monte Carlo Simulation Planning process by clicking on the "Run Planning Simulation" button. The tool generates diversified scenarios and optimizes decision pathways based on the specified planning objectives.

Explore Scenario Outcomes:

Explore the outcomes of the simulation through interactive charts and reports. Gain insights into the diverse range of planning scenarios, resource requirements, and optimal decision pathways.

Optimize Decision-Making:

Utilize the insights gained from Monte Carlo Simulation Planning to optimize decision-making. Identify robust planning strategies, allocate resources effectively, and make informed decisions that account for uncertainties in the planning landscape.

Asset Liability Modeling

The Asset Liability Modeling (ALM) feature on The Satoshi Terminal is a comprehensive tool designed to optimize financial decision-making by aligning assets and liabilities within an organization. This advanced functionality allows users to simulate different financial scenarios, assess the impact of various factors, and strategically manage assets and liabilities to achieve organizational objectives. Below is a detailed description of the Asset Liability Modeling feature:

Description: The Asset Liability Modeling feature on The Satoshi Terminal empowers organizations to enhance financial planning and decision-making by effectively aligning assets and liabilities. This advanced tool employs sophisticated modeling techniques to simulate various financial scenarios, providing insights into the impact of market conditions, interest rates, and other factors on the organization's financial position. ALM enables users to optimize asset and liability management strategies to achieve long-term financial goals.

Key Features:

Scenario Simulation:

The feature allows users to simulate different financial scenarios, considering variations in interest rates, market conditions, and other relevant factors. This enables organizations to assess the impact of external factors on their financial position.

Cash Flow Projection:

ALM provides detailed cash flow projections, helping organizations understand the timing and magnitude of cash inflows and outflows. This insight aids in liquidity management and ensures effective matching of assets and liabilities.

Risk Management:

Assess and manage risks associated with asset and liability positions. ALM facilitates risk analysis by considering factors such as interest rate risk, market risk, and credit risk, allowing organizations to implement risk mitigation strategies.

Optimization Strategies:

Users can develop optimization strategies to align assets and liabilities effectively. This includes adjusting the investment portfolio, refinancing debt, and implementing other financial strategies to achieve desired risk-return profiles.

Customizable Modeling:

Customize the ALM modeling process by specifying parameters such as time horizons, interest rate assumptions, and market scenarios. Tailor the modeling to align with the organization's unique financial landscape.

Visualizations and Reports:

Access interactive visualizations and detailed reports that present ALM results in a clear and actionable format. Visual representations aid in understanding the impact of different scenarios on financial positions.

How It Works:

Define ALM Parameters:

Specify ALM parameters, including time horizons, interest rate assumptions, and market scenarios. Customize the modeling process to align with the organization's financial goals and risk tolerance.

Run Asset Liability Modeling:

Initiate the Asset Liability Modeling process by clicking on the "Run ALM" button. The tool generates simulations, considering various scenarios to project cash flows, assess risks, and optimize asset and liability positions.

Explore Simulation Results:

Explore the results of the ALM simulations through interactive charts and reports. Gain insights into cash flow projections, risk exposures, and the effectiveness of optimization strategies.

Strategic Decision-Making:

Utilize ALM results for strategic decision-making. Identify opportunities to optimize asset and liability positions, manage risks effectively, and align financial strategies with organizational objectives.

Implementation of Strategies:

Implement optimization strategies based on ALM insights. This may include adjusting investment portfolios, refinancing debt, or making other financial decisions to achieve a more favorable asset and liability structure.

Portfolio Backtesting

Asset Allocation Backtesting

The Asset Allocation Backtesting feature on The Satoshi Terminal is a robust tool designed to evaluate the historical performance of different asset allocation strategies. This specialized functionality enables users to assess the effectiveness of portfolio allocations over past periods, allowing for data-driven insights and informed decision-making. Below is a comprehensive description of the Asset Allocation Backtesting feature:

Description: Asset Allocation Backtesting on The Satoshi Terminal is tailored for investors and portfolio managers aiming to assess the historical performance of asset allocation strategies. This feature enables users to backtest various portfolio allocations against historical market data, offering valuable insights into how different strategies would have performed in past market conditions. By leveraging historical data, users can make informed decisions about the effectiveness of asset allocation approaches.

Key Features:

Historical Performance Evaluation:

The feature allows users to evaluate the historical performance of different asset allocation strategies. This includes assessing returns, risk metrics, and other key performance indicators over specified historical periods.

Scenario Comparison:

Users can compare multiple asset allocation scenarios by backtesting against historical market data. This facilitates a side-by-side assessment of how different allocation strategies would have fared in various market conditions.

Risk-Return Analysis:

Conduct a comprehensive risk-return analysis by examining the trade-offs between risk and return associated with different asset allocation approaches. Understand the historical performance dynamics of each strategy.

Dynamic Parameter Adjustment:

Backtesting allows for the dynamic adjustment of parameters, such as asset weights and rebalancing frequencies. Users can explore the impact of different parameter choices on the historical performance of asset allocation strategies.

Statistical Metrics:

Access a range of statistical metrics that quantify the performance of asset allocation strategies. Metrics may include Sharpe ratio, standard deviation, maximum drawdown, and other relevant indicators for comprehensive analysis.

Visualizations and Reports:

Interactive visualizations and detailed reports present Asset Allocation Backtesting results in a format conducive to decision-making. Visual representations aid in understanding the historical performance dynamics of each strategy.

How It Works:

Select Asset Allocation Strategies:

Choose the asset allocation strategies for backtesting. Specify the weights assigned to different asset classes, rebalancing frequencies, and any other relevant parameters.

Define Historical Periods:

Specify historical periods for backtesting, considering different market conditions and economic cycles. Users have the flexibility to assess the performance of asset allocation strategies over varying time horizons.

Run Asset Allocation Backtesting:

Initiate the Asset Allocation Backtesting process by clicking on the "Run Backtest" button. The tool leverages historical market data to simulate the performance of selected asset allocation strategies over the specified periods.

Explore Backtesting Results:

Explore the results of the backtesting process through interactive charts and reports. Gain insights into the historical performance, risk characteristics, and statistical metrics associated with each asset allocation strategy.

Optimize Allocation Strategies:

Utilize backtesting insights to optimize asset allocation strategies. Identify strategies that have historically performed well and refine allocation parameters for improved risk-adjusted returns.

General Portfolio Backtesting

The General Portfolio Backtesting feature on The Satoshi Terminal is a comprehensive tool designed to assess the historical performance of investment portfolios. This versatile functionality enables users to backtest various portfolio configurations against historical market data, offering insights into risk, return, and overall effectiveness. Below is a comprehensive description of the General Portfolio Backtesting feature: